Table of Contents

For many who need to make some money in real property, there are lots of different types of funding property from which to decide on. One other one of the investment sorts you may look into involves venture capital teams. The riskiness of a inventory is set by the corporate that you’ve got invested in. Therefore the return can range greatly. Here, the investors get higher interest than a straight financial savings account.

Not all actual property markets are depressed. In general, should you want your capital within 5 years, will probably be finest to place your money into an investment with a fixed value to keep away from the danger of creating a loss. The stock market can be a big scary place for many who know little or nothing about investing.

Because hard money is commonly a last resort for borrowers who cannot qualify for other kinds of loans, exhausting cash lenders will usually impose very high prices on their loans. A fixed charge has the advantage of certainty of what your earnings might be, whereas a variable charge offers the potential for greater returns if market situations change favourably.

An excellent instance of excessive threat actual property would be investing your money in an old condominium building; renovating the property with the expectation that you will be able to rent out the apartments for more than what they are at the moment price.

The place Ought to I Put My Savings? Totally different Types Of Funding Accounts

anonymous,uncategorized,misc,general,other

Are You Willing To Dwell On The Edge? Understanding Sorts Of Investments

People who are conservative favor to invest in money type of investments. It has been seen that many moderate buyers desire to invest in actual estate that has low danger connected to it.

types of real estate investment firms, investment types ranked by risk, investment types pdf, types of real estate investment trusts, investment types real estate

Different Types Of Investments

What is the best sort of funding? Many individuals buy lists of foreclosure property hoping to make an excellent funding. Primarily based on the form of investor you are, you possibly can make investments both in excessive risk investments or low danger investments. You need to choose investments that match your risk tolerance.

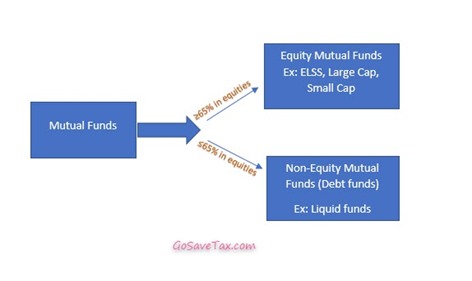

However, the price of the safety of your investment is the relatively low potential return. This means that they are the investors who will have interest bearing savings accounts, or they may make investments their cash into mutual funds, CDs or Treasury payments.

The four Types Of Actual Estate Investor Financing

If you are looking to invest money somewhere, you would possibly consider putting your funding right into a startup enterprise. Investing in your personal home is definitely necessary; nonetheless, investing in actual property total could be a very wise enterprise. When discussing forms of investment property, the subject of rental properties often arises. Since technically your cash is being spread out into bonds, stocks, international investments, and more, the chance of losing all your cash turns into lower.

In case your aim is to maintain the purchasing power of your capital or enhance your wealth over time then your funding will need to develop in worth by no less than the rate of inflation. Exhausting cash is so-referred to as because the loan is supplied more against the exhausting asset (in this case Actual Estate) than it’s towards the borrower.

investment types real estate, types of real estate investment firms, investment types for startups

In Australia over the past 50 years property has averaged around 10{8671537cf99400608fb528d5b7392c4a012cb240371f50cd47b99124c6cc6f1e} p.a. compound development. The first of these, Versatile Spending Accounts are additionally known as section one hundred twenty five plans or “cafeteria plans.” This plan allows participants to place pre-tax cash into the account annually to cowl medical health insurance deductibles, co-funds, dental care and other medical expenses.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4KQGYICZ3JPZTNNKFVZ36FWTZI.jpg)

:max_bytes(150000):strip_icc()/risk_management-5bfc36abc9e77c005182400f.jpg)

More Stories

Investing Information Good Or Bad

Funding Types

A Enterprise Plan For Real Estate Investing