Table of Contents

In the big world of investing, it appears we hear quite a bit about what securities to spend money on, but not as much about what types of accounts to spend money on. There are so many several types of funding accounts, each masking a distinct objective, and new forms of accounts seem to be created weekly. Another type of investment property is a rehab home. They are going to make investments their cash in business ventures and high risk actual property. There is quite a bit to study each totally different investment sort. Selecting an training savings account relies upon upon what your lengthy-term objectives are for the money.

The several types of investments additionally cater to the two levels of risk tolerance: high risk and low threat. The second kind of medical financial savings account is a Well being Reimbursement Arrangement. Many investors make hundreds of dollars playing the flip sport in the real estate market.

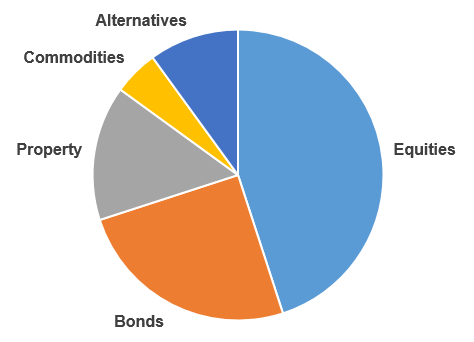

For a set period, bonds lock away the investor’s money. Financial savings in any kind creates a more secure monetary future and permits for problems or emergencies to be taken care of without having to acquire loans or dip into less liquid financial savings reminiscent of a house or different bodily property.

Investments are taxed otherwise relying on how they are structured. The traders make investments money within the bonds for a certain time, to get it back at a selected rate of interest. On the whole, the much less threat you are taking, the decrease your investment return might be. Make sure you know what dangers are concerned with your proposed investment and that the return displays the risks.

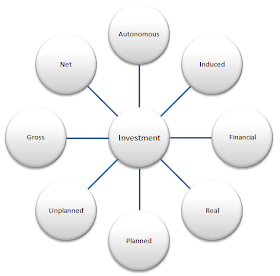

Are You Willing To Dwell On The Edge? Understanding Sorts Of Investments

anonymous,uncategorized,misc,general,other

Totally different Sorts Of Investments

Typically, the much less threat you take, the decrease your funding return will probably be. Be sure you know what risks are concerned with your proposed funding and that the return displays the dangers.

types of real estate investment loans, investment types for startups, investment types by risk chart

The 4 Sorts Of Actual Estate Investor Financing

General, there are a number of different kinds of investments. Throughout the United States there is a drought in the real estate market. And, laborious cash lenders can typically make fast lending choices, offering turn-around instances of only a couple days on loans when vital. Investment Property with Flexible Phrases: A lot of these funding properties are the ones which can be bought with no cash down or with very little money down.

Investments can produce a return by way of earnings (curiosity or dividends) or capital achieve (improve within the value of the investment) or a mix of the 2. Offered by any bank, a savings account lets you set money aside and receive a variable or fastened interest rate depending upon the account.

Investment Sorts

:max_bytes(150000):strip_icc()/llc-operating-agreements-56a090fe5f9b58eba4b19f20.jpg)

Since real estate investing encompasses so many varieties of investment properties, its essential to classify them and pick the one which they’re most enthusiastic about. Your investment timeframe ends when you need access to your investment capital moderately than the revenue from that capital. Investing in shares means you’re changing into a part owner of the company. Nonetheless, generally, the investors can withdraw the deposited cash for the buying and selling goal.

If your goal is to maintain the buying power of your capital or increase your wealth over time then your investment might want to grow in worth by at the least the speed of inflation. Exhausting money is so-referred to as as a result of the loan is provided extra towards the onerous asset (on this case Real Estate) than it’s against the borrower.

investment types by risk, types of real estate investment pdf, investment types wiki

Due to the totally different success stories of many buyers, investing now turned a standard subject during break durations and on the streets. Bank Mounted Time period Investment: The lump sum money deposited for a set term usually six or twelve months is locked away by the bank for a set period. However, the price of that prime return is the chance of dropping some or all your investment. Laborious cash lenders are sometimes wealthy enterprise individuals (both buyers themselves, or professionals similar to docs and legal professionals who’re on the lookout for a great return on their saved money).

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4KQGYICZ3JPZTNNKFVZ36FWTZI.jpg)

:max_bytes(150000):strip_icc()/risk_management-5bfc36abc9e77c005182400f.jpg)

More Stories

Investing News Good Or Dangerous

Investing Information Good Or Bad

What Are Some Of The Typical Enterprise Investment Options In A Residence Business