You only have a pair much more times to earnings in two different approaches from tax-decline promoting.

I’m referring to the sale of stocks you are keeping at a reduction in buy to offset the money gains you have formerly recognized so far this 12 months, and on which you will normally have to pay back tax this coming April.

The second option to revenue traces to the tendency of shares offered in December to bounce back in the New 12 months. You could thus want to get again into the shares you offered by the conclusion of the 12 months.

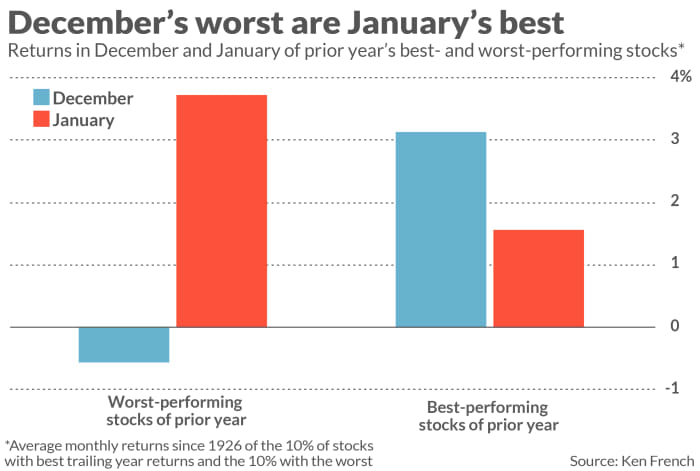

Several are not informed of this bounce back tendency, and so thus skip out on the 2nd 50 percent of this two-pronged year-end approach. But it’s really pronounced, as you can see from the chart down below, which reviews the average every month returns in December and January of the trailing year’s worst- and ideal-doing stocks. To set getting rid of stocks’ rebound in context, look at that on an annualized foundation they develop the equivalent of a 55% acquire in January.

There is a capture: The IRS disallows your tax losses if, in 30 times you repurchase the shares you have offered. It is for the reason that of this so-termed clean sale rule that you do not have a great deal time still left this 12 months to offer the shares you’re holding with a reduction and repurchase them by the conclusion of December. If you as a substitute wait right until mid- or late-December to harvest your tax losses, you may overlook out on the bulk of your stocks’ possible January rebound.

What if you really don’t want devote December out of the stocks you’d otherwise look at promoting for tax-reduction applications? The only solution I know of is to uncover other securities that are really correlated with them, and to substitute these new kinds through the 30-working day wash-sale period of time. To the extent your substitutes conduct as properly as your initial holdings, you won’t be lacking out on any gains even though nonetheless currently being able to harvest tax losses.

To illustrate, look at Exxon Mobil

XOM,

which was just one of 2020’s most important losers and as a result in the crosshairs of investors looking for losses to harvest for tax reasons. A excellent substitute would have been the Electricity Find Sector SPDR

XLE,

considering that — as the chart beneath shows —the two securities are extremely correlated. To quantify their close correlation, think about that the correlation coefficient of their weekly modifications above the final five years is .93 — rather near to the 1. coefficient which would point out a excellent correlation.

You won’t generally be capable to come across a protection that is as really correlated as Power Pick Sector SPDR is to Exxon Mobil, but your intention must be to come across one with a correlation coefficient of .7 of increased. From a statistical point of look at, that means you’re acquiring a protection whose gyrations can make clear or predict at the very least fifty percent of the actions of your tax decline sale candidate.

Numerous on-line resources find substitute securities that are highly correlated with your tax-reduction-sale candidates. For the visually-minded among the you, go to the “Advanced Charting” tab that is furnished on the MarketWatch web page for any stock. By inputting a further ticker in the “Compare” box you can see a cost chart of the two securities and how closely they are correlated.

The additional statistically-minded amid you can use instruments these as the “Correlation Tracker” available at the Select Sector SPDR web page and the “Assets Correlation” resource at the Portfolio Visualizer site.

But get likely. You do not have a instant to shed.

Mark Hulbert is a normal contributor to MarketWatch. His Hulbert Rankings tracks expenditure newsletters that spend a flat price to be audited. He can be reached at [email protected]

Far more: Is investing in overseas shares a great idea?

Furthermore: Getting shares with borrowed money isn’t as outrageous as it sounds

More Stories

Risk Management Techniques for Active Traders

Stock Trading Strategies for Active Traders

Global markets update: US stocks decline as Fed hints it may hike rates again